The Problem With Halal ETFs

We've already done an in-depth comparison of the different halal ETFs, so if you haven't read that already, check it out first. The first halal ETF to hit the US exchanges was only in mid-2019, so all of the entrants in this space are still fairly new.

And while it's great that we've finally got some halal US-listed ETFs that we can use to invest in the markets, they all come with their own challenges. It's important to address them all so you're well informed of the risks involved.

Let's dive in.

Problems with Halal ETFs

Very High Fees

The first, most obvious problem, relates to the Fund Expense Ratio (or just "Expense Ratio"). The cheapest halal ETF, HLAL, charges a whopping 0.49% / year — that's compared to the 0.02% that VOO charges to track the S&P500. That's 25 times more expensive!

This might seem like we're splitting hairs (since we're talking about small percentage points), but remember that this fee is levied every single year, over the entire amount of invested assets that you hold in the fund. Most investors use ETFs as a long-term investment vehicle — so even small differences in fees compound massively over time.

Let's make this more concrete. We built a simple tool to demonstrate the impact this fee would have on different investment amounts:

Low Volume & Liquidity

The average daily trading volume of the five halal ETFs tracked by Bloomberg is a mere $4.4 million. That's peanuts for any ETF, let alone one that's supposed to be invested in highly liquid, high-quality stocks.

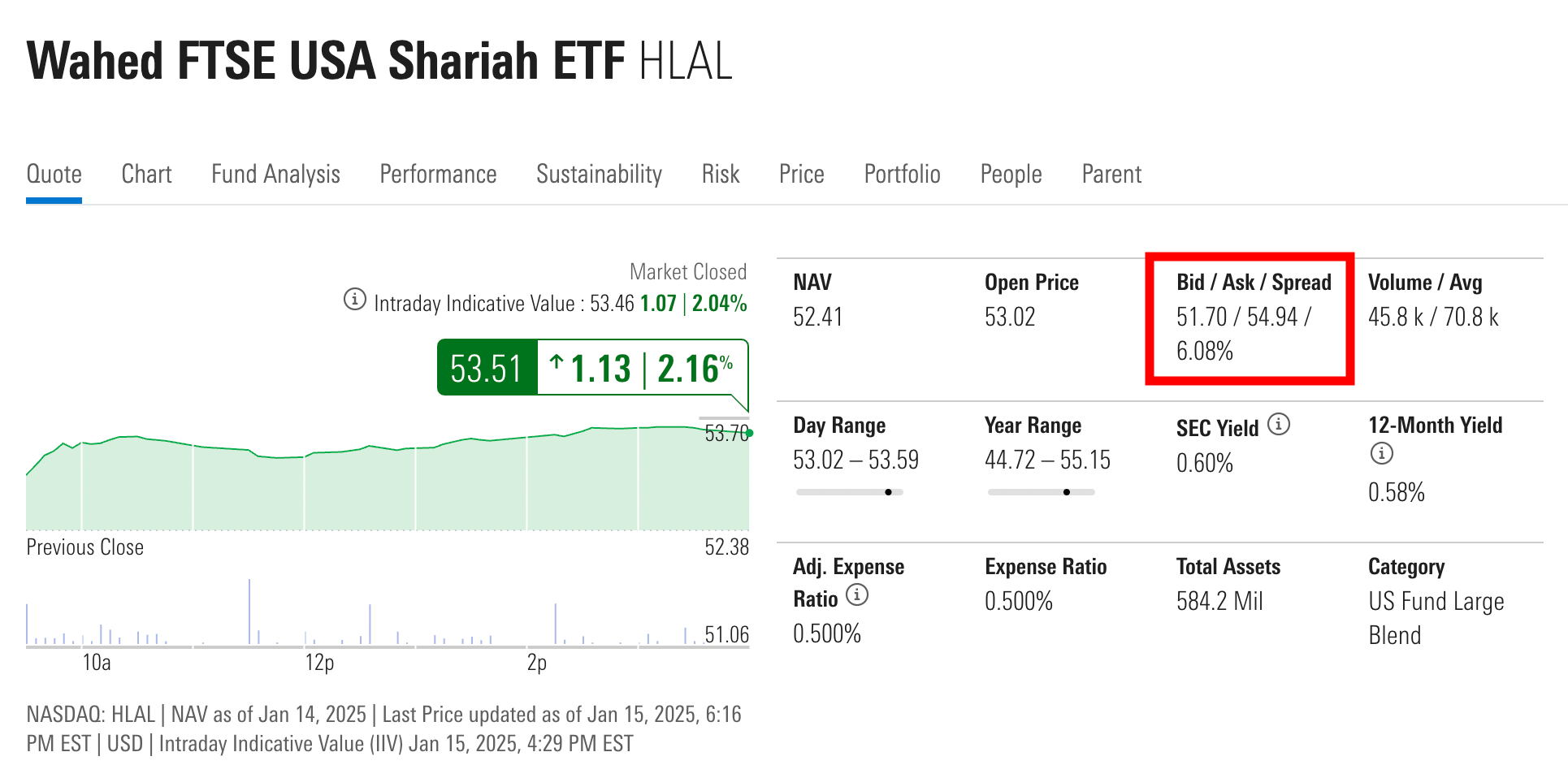

As a result, the bid-ask spread on halal ETFs is huge -- as much as 6.08% on the HLAL ETF. The bid-ask spread is the difference between the highest price a buyer is willing to pay, and the lowest price a seller is willing to accept.

Wide bid/ask spreads can have a significant impact on returns when buying and selling ETFs. Consider the example of HLAL below (this snapshot taken on Jan 15, 2025):

If you buy HLAL at the ask price of $54.94 and later sell it at the bid price of $51.70, your return will be -5.9% even if the fund value remained unchanged! This spread is significantly wider than what you'd see in conventional ETFs, where spreads are typically just a few basis points (0.01-0.05%).

It's also worth noting that many brokers don't offer halal ETFs to their customers and some that do charge higher commissions than they would for conventional ETFs or mutual funds.

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

Poor Diversification

Most halal ETFs have a very high concentration in their holdings, which defeats the purpose of investing in ETFs in the first place.

This becomes abundantly clear when you compare the concentration of the Top 10 holdings in each fund to those of the non-compliant equivalents:

| Ticker | Fund Name | Top 10 holdings (%) |

|---|---|---|

HLAL | Wahed FTSE USA Shariah ETF | 48.10% |

SPUS | SP Funds S&P 500 Sharia Industry Exclusions ETF | 44.09% |

VOO | Vanguard S&P 500 ETF (Non-compliant) | 27.59% |

The difference is abundantly obvious, with the concentration in the Top 10 holdings almost double that of the non-compliant S&P500. What's more, AAPL is often the highest single-stock weighting. This is despite the widespread news coverage of Apple's dubious involvement with 7 of their suppliers accused of using forced labor from Xinjiang, China. Halal ETFs did not move to exclude them — despite the outcry from many individual Muslim investors.

A Better Way 🏆

Let's address the elephant in the room: Halal ETFs are fundamentally broken. We've seen how they charge excessive fees, suffer from dangerous concentration, and mostly underperform the market. But here's the thing - it doesn't have to be this way.

What if you could get all the benefits of ETFs without any of these problems?

Think about it: An ETF is just a basket of stocks 🧺 The only reason we buy ETFs instead of individual stocks is convenience - it's easier to buy one thing than hundreds of things. But this convenience comes at a steep cost: high fees, poor diversification, and compromises on what stocks are included.

This got us thinking: What if you could make your own ETF?

Theoretically, you could replicate any ETF by buying the underlying stocks in the right proportions. You'd get:

- Zero fund expenses (saving you thousands per year)

- Perfect liquidity (since you're buying the actual stocks)

- Complete control over what goes in your portfolio

- True diversification across any market segment you choose

The obvious challenge? Managing hundreds of individual positions would be a nightmare. Keeping track of weights, rebalancing, handling corporate actions - it would be a full-time job.

That's exactly why we built Amal Invest.

This innovative tool solves every major problem with halal ETFs:

-

The Fee Problem: While SPUS charges you 0.49% annually ($490 per $100,000 invested), Amal Invest has zero ongoing fees. Over 30 years on a $100,000 investment, this difference alone could save you over $150,000.

-

The Liquidity Problem: Forget about wide bid-ask spreads eating into your returns. Since you're buying actual stocks, you get perfect liquidity and true market prices.

-

The Diversification Problem: Instead of being forced into funds with 40-70% concentration in just 10 stocks, you can create truly diversified portfolios across any market segment.

-

The Compliance Problem: Full control means you can exclude any companies that don't meet your ethical standards - whether that's companies with concerning labor practices, those supporting genocide, or any other ethical concerns.

You get all the convenience of ETFs while keeping complete control over your investments and avoiding unnecessary costs. Think about it:

- 📈 Better performance through eliminated fees and proper diversification

- 💸 Zero ongoing expenses

- ✅ 100% compliant funds with customizable ethical filters

- 🌊 Perfect liquidity at true market prices

- 🎯 The ability to customize to your specific needs

We've built what we wish existed when we started investing: a tool that gives you the benefits of professional fund management while keeping you in control of your money and your values.

Ready to Invest Better?

Visit amalinvest.com to learn how you can start building your own optimized halal portfolio today.

Check out Amal Invest →- Previous

- Halal ETFs Compared