Top 10 Halal Stocks in Retail in the US Market

The retail sector is a vital part of the economy, as it involves the sale of goods and services to consumers for their personal or household use. This sector is a major contributor to the economy, as it accounts for a significant portion of consumer spending and provides employment opportunities for many workers. In this essay, we will be discussing the top 10 halal stocks in the retail sector in the US market. These stocks have been carefully chosen based on their potential for growth and their compliance with Islamic law. Investing in halal retail stocks can be a smart move for investors who want to align their investments with their values. The retail sector is highly competitive, and retailers must constantly adapt to changing consumer preferences and market conditions in order to succeed.

Understanding The “Halalness” Of The Retail Sector

Halal investing in the retail sector involves investing in companies that operate in accordance with Islamic principles. This typically involves avoiding businesses that engage in activities that are considered to be forbidden or immoral under Shariah, such as the production or sale of alcohol or pork products, or the charging of interest.

The challenge in this sector is that it is very broad and a single line of a product can make it non-compliant if it is generating more than 5% revenue. Does that mean it is rare to find a shariah-compliant stock in the US market from the retail sector? Fortunately, no it is not in fact, only 4 companies are non-compliance in amongst the top 20 companies, so let’s take a deeper look at the sector, and see why some stocks did not make it to our list and are considered non-compliant. Then I will be listing the top halal stocks in retail afterward.

So as I said before, three ratios should be made to know if a stock is halal or not. These calculations are revenue ratio, interest ratio, and debt ratio. What I noticed in the retail sector is that the debt ratio is where the majority of the stocks are failing while the other 2 ratios are passing. The reason is these retail stores rely highly on debt till it becomes more than the acceptable threshold to be considered compliant. Let’s take an example:

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

Kroger 'KR'

- Revenue Ratio: for a stock to be s shariah-compliant, this ratio should be < 5% and in this stock, it is only 0.01% revenue ✅

- Interest Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is only 3.87% ✅

- Debt Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 46.67% ❌

The same (with different figures) applies to the following stocks:

- CVS Health (CVS)

- Walgreens Boots Alliance (WBA)

- Albertsons (ACI)

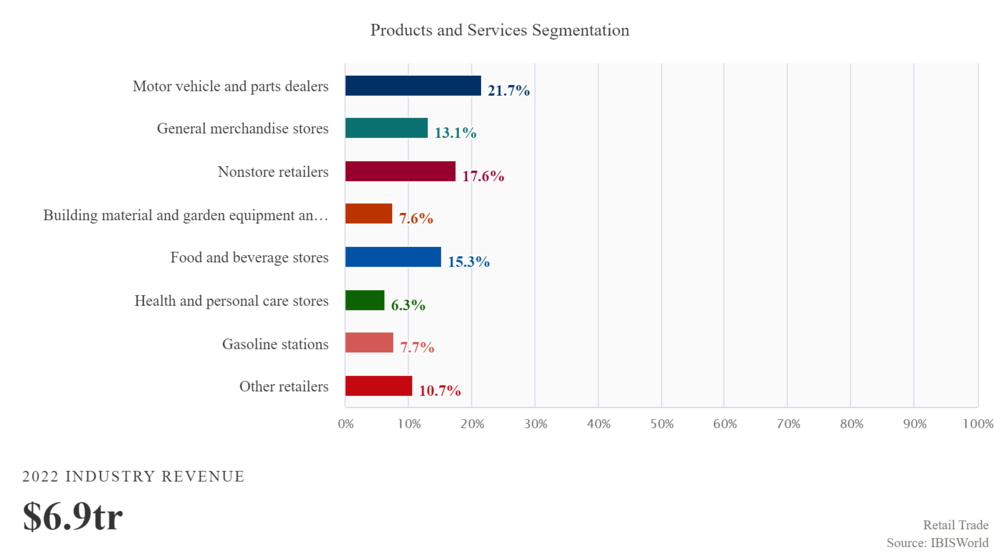

Retail Sector Core Activities

| Primary Activities | Major Products |

|---|---|

| Motor vehicle and parts dealers, furniture and home furnishings stores, electronics and appliance stores, and building materials and garden equipment | Food and beverages stores |

| Sell food and beverage products | Health stores |

| Sell clothing and clothing accessories stores | Garden and building materials |

| Sell gasoline and other automotive products | Nonstore retailers |

| Sell sporting goods, hobbies, books, and music | Parts of motor and vehicles |

| General merchandise stores | Gas stations |

| Sell products through methods such as online sales or mail order | General stores |

So from the table above, we can see how broad this sector is and how its activities are considered shariah-compliant (Sell & buy) as long as the products are shariah-compliant as well.

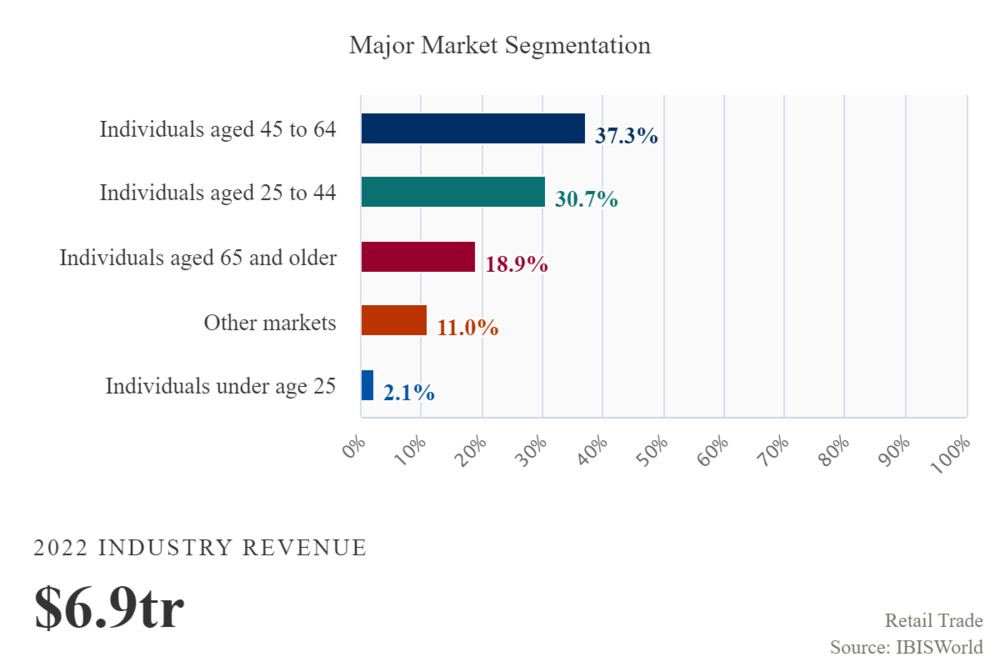

As shown above, this sector depends 100% on the revenues of its products so it is considered halal as long as these products are shariah-compliant. Let’s see from the following chart which markets this sector serve

The majority of the products provided by retailers are individuals who use these products in their daily life activities (eat, drink, repair, clean, read, listen … etc) and this is not considered as something against Islamic law.

Now, Here are the top 10 halal stocks in the Retail Sector

Let's take a look!

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

Home Depot 'HD'

It is a retailer of home renovation products. The Home Depot locations sell a variety of construction materials, home improvement products, garden and lawn products, and decorating products, as well as facility maintenance, repair, and operations items. The company also provides installation services. their products can be found on websites such as homedepot.com, blinds.com, which sells custom window coverings, and thecompanystore.com, which sells textiles and decorating products. Home Depot has a market cap of $334.28 Billion.

Lowe's Companies 'LOW'

a home improvement retailer in the United States and around the world that sells products for building, maintenance, repair, remodeling, and decoration. It sells home improvement products and also provides installation services in various product categories through freelancers; additional insurance plans; and in-warranty and out-of-warranty repair services. The company sells its items on the websites Lowes.com and Lowesforpros.com, as well as through mobile apps. Lowe's Companies has a market cap of $129.91 Billion.

TJX Companies 'TJX'

functions as a retailer of home and clothing styles at reduced prices. Marmaxx, HomeGoods, TJX Canada, and TJX International are its four business segments. The business sells family clothing, including footwear and accessories; home fashions, including home essentials, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tables, and kitchenware; jewelry and accessories, and other products. TJX Companies has a market cap of $92.94 Billion.

AutoZone 'AZO'

It sells and distributes vehicle parts and accessories. The company provides a variety of automotive goods. Additionally, the company offers a sales program that includes commercial credit and part and product delivery, sells automotive diagnostic, and repair software under the ALLDATA brand, automotive parts, maintenance items, accessories, and non-automotive items through autozone.com. AutoZone has a market cap of $48.81 Billion.

Ross Stores 'ROST'

The company uses the Ross Dress for Less and dd's DISCOUNTS brand names to run off-price retail clothing and home fashion stores. Its main items are clothes, footwear, accessories, and home fashion products. The company's dd's DISCOUNTS stores offer its products at department and discount stores for households with moderate income. While Ross Dress for Less stores sells its products at department and specialty stores mostly to middle-class households. Ross Stores has a market cap of $41.30 Billion

CDW Corporation 'CDW'

In the United States, the United Kingdom, and Canada, the company offers information technology (IT) solutions. It works in three divisions: corporate, small business, and government. The business provides both separate hardware and software products and services, as well as complete IT solutions. It serves customers in government, education, and healthcare. CDW Corporation has a market cap of $25.72 Billion

ULTA Beauty 'ULTA'

It is a beauty product shop. Cosmetics, perfumes, skincare and haircare products, bath and body products, and salon styling equipment are available in the company's stores, as are professional hair products and salon services. It also sells its own brand products, such as Ulta Beauty Collection cosmetics, skincare, and bath products. It als sells its products via its website ulta.com and mobile applications. ULTA Beauty has a market cap of $24.14 Billion

Best Buy 'BBY'

It sells technology in the United States and Canada. The company is divided into two divisions: domestic and international. Its stores provide computing products, networking, and appliances, as well as entertainment products. It also offers consultation, delivery, designing, health-related, setup, subscriptions, maintenance, technical support, and warranty services. The company sells its products through Best Buy, Best Buy Ads, and Best Buy Business shops and other websites. Best Buy has a market cap of $19.49 Billion

Burlington Stores 'BURL'

It is a retailer in the United States of branded garment products. The company sells clothing for women, men, and children, as well as footwear, accessories, toys, presents, and outerwear, as well as baby, lifestyle, and beauty products. Burlington Stores has a market cap of $13.05 Billion

Deckers Brands 'DECK'

It produces, markets, and distributes footwear, clothes, and accessories for casual lifestyle usage and high-performance activities through its subsidiaries. The company sells high-quality products Under the UGG brand. Department shops, domestic independent action sports and outdoor specialized footwear retailers, bigger national retail chains, and internet retailers distribute the company's products. It also sells its products directly to customers through retail stores and e-commerce websites and distributes them through distributors and merchants in the United States, Europe, Asia-Pacific, Canada, Latin America, and beyond. Deckers Brands has a market cap of $10.30 Billion

Summary

The retail sector is an important part of the economy that involves the sale of goods and services to consumers for personal or household use. This sector plays a significant role in consumer spending and employment, we selected the top 10 halal retail stocks in the US market for their potential for growth and compliance with Islamic law. Investing in these stocks can be a way for investors to align their values with their investments. The retail sector is competitive, and retailers must be adaptable in order to thrive in changing market conditions.

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

- Previous

- Top REITs