Top 10 Halal Stocks in Clothing Sector in the US Market

Investing in the clothing sector can be a rewarding and exciting opportunity. The global market for clothing and apparel is vast and diverse, with billions of consumers around the world. When investing in clothing stocks, it's important to research the financial performance of the companies you're interested in and to look for companies with strong revenue growth, profitability, and cash flow. It's also important to carefully evaluate the risks and challenges facing the clothing industry, including competition, changing consumer preferences, and economic conditions. By understanding the market, evaluating the financial performance of companies, and considering the risks and challenges facing the industry, investors can make informed and strategic investment decisions in the clothing sector.

Understanding The “Halalness” Of The Clothing Sector

Halal investing in the clothing sector is a cool way for Muslim investors to put their money where their values are. Basically, it means investing in companies that produce and sell clothing that is permissible under Islamic law. This can include avoiding clothing that is made from materials that are not allowed under Islamic law, such as pork-based products. It can also include avoiding clothing that is produced or marketed in a way that is not consistent with Islamic values and beliefs. Halal investing in the clothing sector can provide investors with the potential for financial returns, while also supporting the growth of the halal clothing industry and promoting the availability of high-quality, ethically-produced clothing.

So while I was screening some stocks in this sector, I was surprised that companies like Guess? Inc is non-compliant, especially since most of the top companies are halal in this sector. But I thought that it wouldn’t harm to know why these stocks are non-compliant.

So let’s see why is Guess? is considered non-compliant:

In a previous post, I explained how we make the calculations to see if a stock is halal or not. We basically make these three calculations: revenue ratio, interest ratio, and debt ratio

This is how Guess? did in these calculations:

-

Revenue Ratio: for a stock to be shariah-compliant, this ratio should be < 5% and in this stock, it is only 99.80% ✅

-

Interest Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 14.57% ✅

-

What I noticed is that Guess? and other non-compliant stocks are failing in the debt ratio, and when a stock fails this ratio it is because the Interest Bearing Debt is > 30% which means that Guess? relies on debt more than it should, to be considered compliant.

Thankfully, the top stocks in this sector are halal and I will be listing them at the end of this post but, let’s take a look at the non-complaint ones to avoid them.

- Kontoor Brands (KTB)

- PVH Corp (PVH)

- Express (EXPR)

- Vince Holding (VNCE)

- Delta Apparel (DLA)

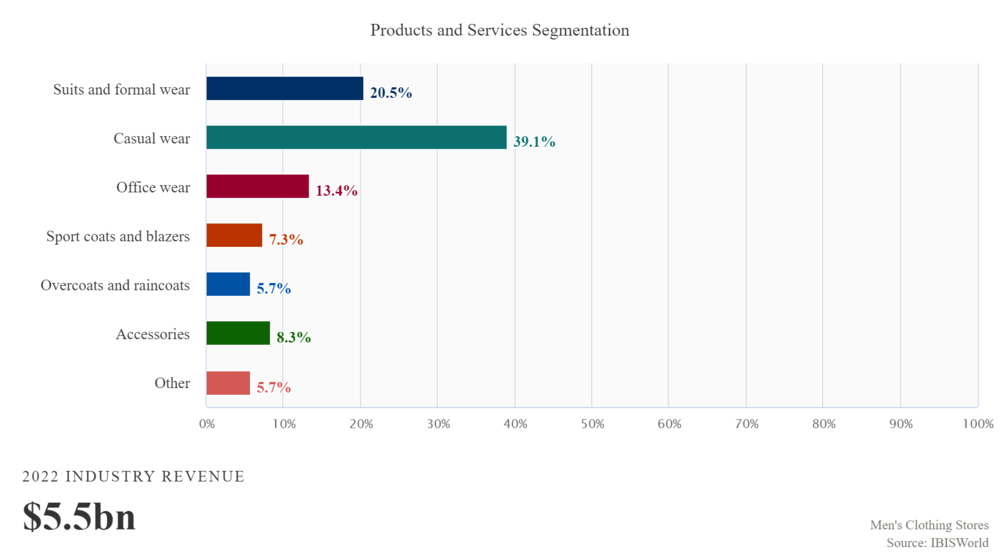

- Rent the Runway (RENT)

This sector has a wide range of industries. Some companies specialize in women’s clothes, while others can specialize in men’s or children’s clothes. Also, some companies may produce only footwear or bags. In this post, I will give an overview of one of these industries just to have an idea of how it operates.

| Primary Activities | Major Products |

|---|---|

| Retailing and formal apparel for women and men | Footwear |

| Retailing casual apparel for women and men | Accessories |

| Retailing apparel for infants and children | Children Clothing |

| Women Clothing | |

| Men Clothing |

Nothing amongst these activities and products is against shariah and as long it was produced, advertised, and sold in an Islamic permissible way then it is halal to invest in its stocks

If the products in the chart were produced in a permissible way then it means they are shariah-compliant but, if its material is pork-based for example then it becomes non-compliant

It appears that the income in this sector depends on selling the product. So as long as the product is shariah-compliant, so will be the revenue.

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

Nike 'NKE'

The company designs, develops, promotes, and sells men's, women's, and children's athletic footwear, clothes, equipment, and accessories globally through its subsidiaries. Additionally, it offers a line of accessories and performance gear that includes backpacks, socks, sports balls, sunglasses, watches, digital gadgets, bats, gloves, protective gear, and other sports-related gear. Nike has a market cap of $171.61 Billion

TJX Companies 'TJX'

functions as a retailer of home and clothing styles at reduced prices. Marmaxx, HomeGoods, TJX Canada, and TJX International are its four business segments. The business sells family clothing, including footwear and accessories; home fashions, including home essentials, furniture, rugs, lighting products, giftware, soft home products, decorative accessories, tables, and kitchenware; jewelry and accessories, and other products. TJX Companies has a market cap of $92.94 Billion

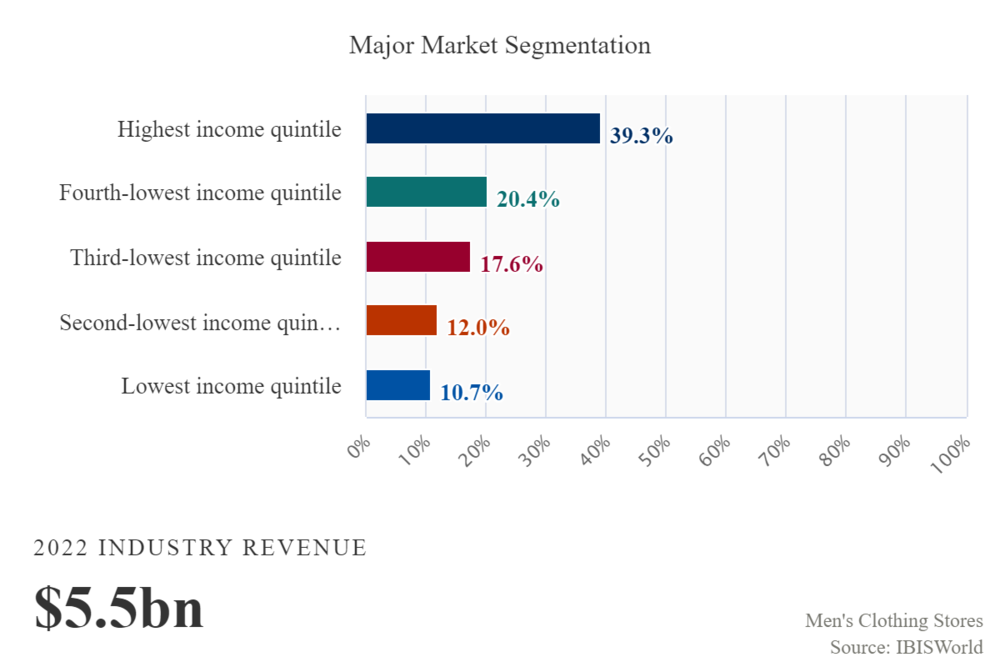

Ross Stores 'ROST'

The company uses the Ross Dress for Less and dd's DISCOUNTS brand names to run off-price retail clothing and home fashion stores. Its main items are clothes, footwear, accessories, and home fashion products. The company's dd's DISCOUNTS stores offer its products at department and discount stores for households with moderate income. While Ross Dress for Less stores sells its products at department and specialty stores mostly to middle-class households. Ross Stores has a market cap of $40.83 Billion

Burlington Stores 'BURL'

operates as a retailer of branded clothing items in the US. The company sells products with a fashion focus, such as jackets, shoes, accessories, toys, and clothing for women, men, teens, and children. Since January 29, 2022, it has 837 stores under the Burlington Stores name, 2 stores operating under the Cohoes Fashions name, and 1 operating under the MJM Designer Shoes name. Burlington Stores has a market cap of $12.75 Billion

VF Corporation 'VFC'

specializes in the manufacture, purchase, marketing, and distribution of branded lifestyle clothing for men, women, and children in the Americas, Europe, and the Asia-Pacific. These products include footwear, clothes, and accessories. The three components that make up its operation are Outdoor, Active, and Work. It sells its products under other brands names like Supreme, Kipling, Napapijri, Icebreaker, Altra, Vans, JanSport, Dickie, and The North Face In addition to selling directly to consumers through retail stores, concession retail stores, e-commerce sites, and other digital channels, the company sells its products to specialized shops, department stores, national chains, and mass merchants. VF Corporation has a market cap of $12.75 Billion

Tapestry 'TPR'

offers branded lifestyle goods and luxurious accessories in the United States, Japan, Greater China, and worldwide. The company has t hree business divisions: Coach, Kate Spade, and Stuart Weitzman. With its various sorts, it offers women's accessories, bag collections, watches, shoes, sunglasses, and fragrances. It offers its products through wholesale customers, concession shop-in-shops, independent third-party distributors, e-commerce websites, and wholesale customers. In October 2017, the business changed its name from Coach, Inc. to Tapestry, Inc. Tapestry has a market cap of $9.10 Billion

Columbia Sportswear 'COLM'

It is specialized in designing clothes, accessories, and footwear and it markets these products all over the world. The company sells its products under the Columbia, Mountain Hardwear, SOREL, and prAna brand names through a network of branded and outlet retail stores it owns, websites, outlet shops and shop-in-shop retail locations, in addition to retail shops that are specialized in sporting and outdoor products. Columbia Sportswear has a market cap of $5.56 Billion

Gap Inc. 'GPS'

The company's main product is clothes for men, women, and children, but it also sells other stuff like accessories, and personal-care products under the Old Navy, Gap, Banana Republic, and Athleta brands for. The company sells its products through company-run stores, franchise stores, websites, agreements with third parties, and catalogs. Gap Inc. has a market cap of $5.30 Billion

Under Armour 'UA'

manufactures, markets, and distributes performance clothing, footwear, and accessories for people of all ages. It sells its products under different brands names like Under Armour, UA, Heatgear, Coldgear, Hovr, Protect This House, I Will, UA Logo, Armour Fleece, and Armour Bra. The company sells its goods through wholesale channels, such as institutional athletic departments, leagues, and teams, national and local sports equipment chains, independent and speciality retailers, department store chains, mono-branded Under Armour retail stores, and independent distributors. Under Armour has a market cap of $4.21 Billion.

UniFirst 'UNF'

It is a North American market leader in the supply and maintenance of managed uniform and workwear programs, as well as the provision of associated facilities services. The company, through its subsidiaries, also produces first aid and safety items, as well as maintains specific workwear programs for the cleanroom and nuclear industries. UniFirst makes its own branded work uniform, protective garments, and floorcare products, has 250 facilities across the country, services over 300,000 commercial customers, and employs 14,000 employee Team Partners. Every business day, the corporation outfits roughly 2 million workers through its managed rental, leasing, and purchase programs. UniFirst has a market cap of $3.61 Billion

Summary

Halal investing refers to investing in companies that produce and sell products that are permissible under Islamic law. In the clothing sector, this can include avoiding clothing made from materials that are not allowed under Islamic law, such as pork-based products, and avoiding clothing produced or marketed in a way that is not consistent with Islamic values and beliefs. Some companies in the clothing sector may not be compliant with halal investing principles due to their production or marketing practices. It is important for investors to research and evaluate the halalness of a company before making investment decisions in the clothing sector.

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

- Previous

- Top chemicals stocks