Top 7 Halal REIT stocks in the US

REITs, or Real Estate Investment Trusts, are companies that own and operate income-generating real estate properties. REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends, which makes them a popular investment option for investors who are looking for regular income streams. REITs can invest in a variety of real estate assets, such as office buildings, apartments, shopping malls, and hotels, or infrastructures such as cell towers or pipelines. REITs can be publicly traded on stock exchanges, or they can be private. Investing in REITs can provide diversification and potentially higher yields compared to other income-generating investments such as bonds.

Understanding The “Halalness” Of REITs

Halal investing in REITs involves investing in REITs that own and operate real estate properties that are compliant with Islamic principles. This typically involves avoiding REITs that invest in properties that are used for activities that are considered to be forbidden or immoral under Shariah, such as the production or sale of alcohol or pork products, or the provision of interest-based financial services. Instead, halal investors may choose to invest in REITs that own and operate properties that are used for activities that are considered to be halal, such as retail or residential properties that are leased to tenants who operate businesses that are compliant with Islamic principles. It is important for halal investors to thoroughly research the REITs they are considering investing in and to ensure that they meet their ethical and religious standards.

While I was preparing the list of the top 10 halal stocks in REITs, I came by non-shariah-compliant stocks and I was curious to know why are they non-compliant So, here is my reasoning:

So as I always do, I have 3 ratios to consider to decide if a stock is shariah-compliant or not: revenue ratio, interest ratio, and debt ratio. In REITs as expected, all the stocks failed in the debt ratio calculation because these companies rely on debt to the level that this ratio exceeds the acceptable threshold to be shariah-compliant. Let’s take an example and see how:

Realty Income (O)

-

Revenue Ratio: for a stock to be shariah-compliant, this ratio should be < 5% and in this stock, it is only 1.14% ✅

-

Interest Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is only 3.34% ✅

-

Debt Ratio: for a stock to be shariah-compliant, this ratio should be < 30% and in this stock, it is 55.24% ❌

here is a list of other top stocks in REIT that are non-shariah-compliant:

- American Tower (AMT)

- Realty Income (O)

- Digital Realty (DLR)

- SBA Communications (SBAC)

- Sun Communities (SUI)

- Kimco Realty (KIM)

- Gaming and Leisure Properties (GLPI)

- National Retail Properties (NNN)

- Prologis (PLD)

REITs Sector Core Activities

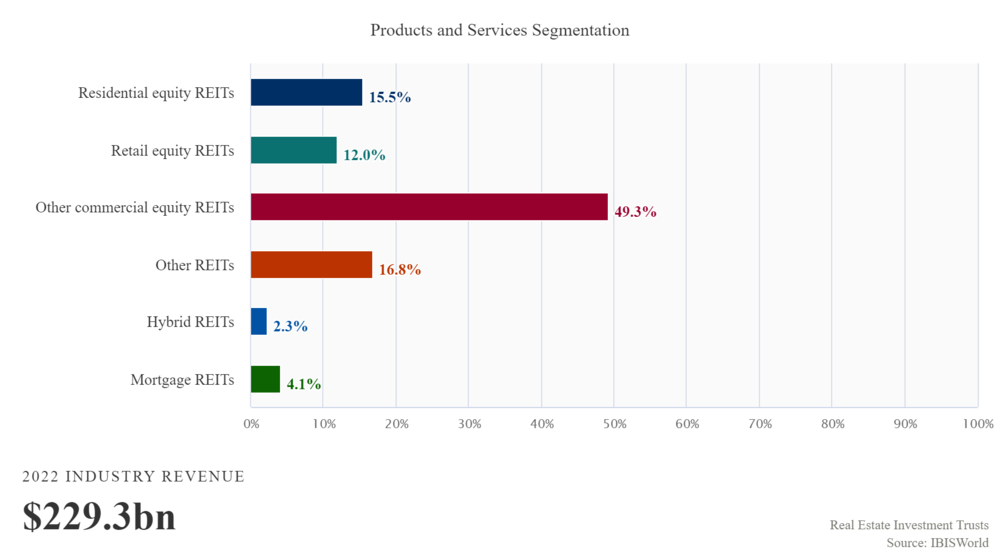

The following table lists the primary activities done in this sector and its major products.

| Primary Activities | Major Products |

|---|---|

| Property purchasing, development, and management involve buying, developing, and managing commercial, industrial, retail, and residential real estate. | Equity REITs are a type of REIT that owns and operates income-generating real estate properties. |

| Mortgage financing involves providing loans to customers for the purpose of purchasing real estate. | Residential equity REITs invest in residential properties such as apartments or single-family homes |

| Sell clothing and clothing accessories stores | Retail equity REITs invest in retail properties such as shopping malls or strip malls. |

| Sell gasoline and other automotive products | Other commercial equity REITs invest in other types of commercial properties such as office buildings or industrial properties |

| Hybrid REITs invest in a combination of different types of properties | |

| Mortgage REITs invest in mortgage-backed securities or provide financing for real estate purchases |

We can see some of these activities are against shariah like mortgages but, the good thing about REITs is that not all of them contain such activities, we can still have REITs that are shariah-compliant

We can see from the chart that the revenues come from the products and services provided in the sector. So, as long as these REITs are shariah-compliant, the revenues are shariah-compliant as well

As shown above, the segments that we can find REITs in can be shariah-compliant as long as all the activities and purposes of these properties are shariah-compliant

Now, Here are the top 10 halal stocks in the REITs

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

Mid-America Apartment Communities 'MAA'

It is known for providing full-cycle and superior investment return for stockholders via ownership, operation, acquisition, construction, and refurbishment of luxury apartment complexes in the United States' Southeast, Southwest, and Mid-Atlantic regions MAA owns 102,772 apartment units, including communities under construction, in more than 10 states since December 31, 2020. Mid-America Apartment Communities has a market cap of $19.49 Billion

Equinix 'EQIX'

It is the world's largest provider of digital infrastructure. They link industry leaders in banking, manufacturing, retail, transportation, government, healthcare, and education in a digital-first world. Business leaders rely on their trusted global platform to bring together and integrate the core infrastructure that drives their success in a sustainable and safe manner. Equinix has a market cap of $63.98 Billion

Crown Castle 'CCI'

It owns, operates, and rents over 40,000 cell towers and roughly 80,000 route miles of fiber in every main U.S. market, providing small cells and fiber solutions. This countrywide network of communications infrastructure connects cities and communities to critical data, technology, and wireless services, delivering information, insights, and technologies to individuals and companies that need it. Crown Castle has a market cap of $60.70 Billion

Equity LifeStyle Properties 'ELS'

The Company owns lifestyle-oriented assets that include property operations, house sales, and rental operations, and (RV) communities. It is divided into two business segments: Property Operations and Home Sales and Rentals Operations. Property Operations owns and operates land leasing assets, as well as Home Sales. At the Home Sales and Rentals Operations division they buy, sell, and rent residences. Equity LifeStyle Properties has a market cap of $12.91 Billion.

Camden Property Trust 'CPT'

It is a real estate company that primarily owns, manages, develops, redevelops, acquires, and constructs multifamily housing projects. Camden owns and maintains 167 buildings in the United States, totaling 56,850 apartments The Company's portfolio will grow to 59,104 apartments across 174 buildings with the completion of seven developments now under construction. Camden Property Trust has a market cap of $12.77 Billion

PotlatchDeltic 'PCH'

It is the owner of 1.8 million acres of timberland in Alabama, Arkansas, Idaho, Louisiana, Minnesota, and Mississippi. The company also runs an industrial-grade plywood mill, six sawmills, a commercial and residential real estate development business, and a rural timberland sales program through its taxable REIT subsidiary. PotlatchDeltic, a pioneer in sustainable forest management, is dedicated to environmental, social, and corporate governance. It has a market cap of $3.85 Billion

Community Healthcare Trust 'CHCT'

It is a REIT that relies on having properties that generate income mainly related to the delivery of outpatient healthcare services in the target sub-markets across the United States. Since September 2020, the Company had about $667.3 million invested in 131 real estate holdings situated in 33 states and totaling roughly 2.8 million square feet. Community Healthcare Trust has a market cap of $0.91 Billion

Summary

Real Estate Investment Trusts (REITs) are companies that own and operate income-generating real estate properties and are required to distribute at least 90% of their taxable income to shareholders as dividends. Halal investing in REITs involves investing in REITs that own and operate properties that are compliant with Islamic principles, such as avoiding properties used for activities that are considered forbidden or immoral under Shariah. To determine the "halalness" of REITs, halal investors may consider three ratios: revenue ratio, interest ratio, and debt ratio. Many REITs may fail the debt ratio calculation because they rely on debt to a level that exceeds the acceptable threshold for compliance with Shariah principles.

- Check your email inbox

- Click "Confirm Subscription" in the email we just sent

- Previous

- Top dividend stocks